How to Buy a House in Phoenix Arizona

Posted by Troy Elston, REALTOR on April 2, 2023

In this guide, we’ll take you through the entire process of how to buy a house in Phoenix Arizona and neighboring cities, from getting your finances in order to closing the deal.

When you buy a house, it’s a big investment and it can be overwhelming to navigate the process, especially if it’s your first time. We understand the challenges that come with buying a house, and we are here to help.

Here’s a step by step summary of how to buy a house in Phoenix and what you’ll find on this page:

- How to Get Your Finances in Order Before You Buy a House

- How to Get Pre-Approved of a Mortgage

- Find the Right House to Buy

- What a Real Estate Agent Can Do for You

- Shopping for a House

- How to Make an Offer on a House

- Why you Need a House Appraisal

- What You Should Do on Closing Day

Steps on How to Buy a House

The process on how to buy a house is never the same for everyone. Buying a house depends on a variety of factors unique to each individual home buyer. With that being said, here is some of the most common steps on how to buy a house in the Phoenix Valley.

Getting Your Finances in Order Before You Buy a House

Before you start looking for a house, it’s essential to get your finances in order. This includes determining how much you can afford to spend on a house, getting pre-approved for a mortgage, and saving for a down payment.

How Much Money Will it Take to Buy a House in Phoenix?

The first step in getting your finances in order to determine how much you can afford to spend on a house. This involves taking a close look at your income, expenses, and debts to determine how much you can realistically afford to pay for a house each month. An experienced loan officer can easily calculate your maximum mortgage amount based on your income, debts and credit history.

Getting Pre-Approved for a Mortgage

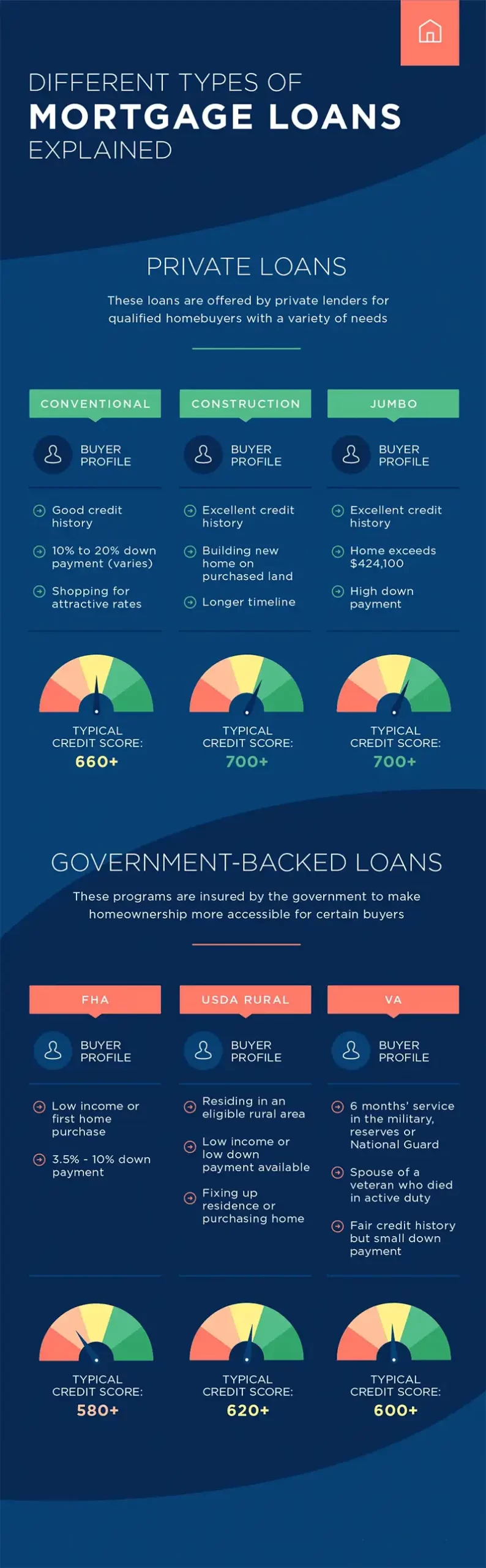

Once you have an idea of how much you can afford to spend on a house, the next step is to get pre-approved for a mortgage. This involves meeting with a lender who will evaluate your financial situation and determine how much you can borrow for a mortgage.

A very important step for qualifying for a home loan is your credit standing. A loan officer will interview you and ask for permission to check your credit and past payment history. Credit scores not only determine if you’re able to get a home loan, they can affect the interest rate of your home loan.

Being pre-approved for a mortgage can give you an edge in the competitive Phoenix housing market and can help you stay within your budget.

To get pre-approved for a mortgage, a home buyer typically needs to follow these steps:

Gather documentation

Before approaching a lender for pre-approval, you’ll need to gather financial documents such as pay stubs, tax returns, and bank statements.

Choose a lender

You can also choose a lender based on factors such as interest rates, fees, and customer service and overall knowledge of his/her products.

Submit an application

You’ll need to complete a mortgage application and provide the necessary documentation to the lender.

Wait for preapproval

The lender will review the application and documentation to determine whether you’re eligible for the pre-approval

Receive PreApproval Letter

If you are approved for a home loan, the lender will provide a pre-approval letter that outlines the amount of the loan and other terms of the mortgage.

It’s important to note that pre-approval does not guarantee final approval of a mortgage loan. The lender will still need to conduct a full underwriting review of the your financial situation and the property being purchased before granting final approval.

If you would like to speak directly with a loan officer, click here so we can provide you with a list of great loan officers in the Phoenix Valley.

Saving for a Down Payment

Another crucial aspect of getting your finances in order is to determine how much down payment for a house is required. Many lenders require a down payment of at least 20% of the purchase price, so it’s essential to start saving early.

If you’re not able to put down 20 percent, don’t worry. Buying a home with a FHA loan only requires a 3.5% down payment. For example, if you buy a house that cost’s $300,000, your down payment is only $10,500. Keep in mind that any down payment under 20% will require mortgage insurance to reduce the risk of default for the lender.

There are various ways to save for a down payment, including setting up a separate savings account, cutting back on expenses, and exploring down payment assistance programs.

Finding the Right House to Buy

Once you have your finances in order, the next step is to start looking for the right house. This involves considering your needs and preferences, exploring different neighborhoods, and working with a real estate agent.

Search for a House to BuyConsider Your Needs and Preferences

Before you start looking at houses, it’s essential to consider your needs and preferences. This includes the size and style of the house, the number of bedrooms and bathrooms, and any must-have features such as a backyard or a garage. By identifying your needs and preferences upfront, you can narrow down your search and focus on houses that meet your criteria.

Explore Different Neighborhoods

Another important aspect of finding the right house is exploring different neighborhoods. This involves considering factors such as location, proximity to schools and amenities, and the overall feel of the neighborhood. By exploring different neighborhoods, you can find the one that best suits your needs and preferences.

Here’s some popular neighborhoods to start with:

Work with a Real Estate Agent

Working with a real estate agent can be incredibly helpful when buying a house. A good agent can help you navigate the housing market, provide valuable insights on neighborhoods and houses, and help you negotiate the best deal.

When selecting a real estate agent, consider using Troy Elston with West USA Realty. Troy is an experienced home buyer’s agent who is knowledgeable and trustworthy.

What Will a Buyer’s Agent Do For Me?

First, what is a Buyer’s Agent? A real estate buyer’s agent is a licensed professional who works exclusively on behalf of a home buyer. Their primary role is to help the buyer find and purchase a home that meets their needs and budget. A buyer’s agent can provide a range of services, including:

- Help the buyer identify their home buying goals and preferences

- Schedule and attend property viewings with the buyer

- Assist with negotiations and offer letters

- Recommend trusted vendors for services such as home inspections and appraisals

- Help the buyer navigate the closing process

To select the right buyer’s agent, there are several key factors to consider

Experience: Look for an agent with a proven track record of success in the local market.

Communication: The right agent should be a good listener, able to understand your needs and preferences, and communicate effectively throughout the home buying process.

Knowledge of the Local Market: The agent should have in-depth knowledge of the local real estate market and be able to provide insights on trends, prices, and neighborhoods.

Professional Credentials: Ensure that the agent is licensed and in good standing with the relevant state regulatory body.

Personal Fit: Choose an agent with whom you feel comfortable and who you believe has your best interests in mind.

By considering these factors, home buyers can select a real estate buyer’s agent who can provide the expertise and guidance needed to make the home buying process as smooth and successful as possible.

How to Shop for a House

When shopping for a house, there are several things to keep in mind to ensure that you find the right property that meets your needs and budget. Here are some tips on what to look for and how to shop for a house:

Start with a Plan

Before beginning your house search, create a list of your must-haves and nice-to-haves in a home. This can include things like location, number of bedrooms and bathrooms, square footage, and yard size.

Work with a Real Estate Agent

A knowledgeable real estate agent can provide you with access to a wide range of properties that meet your criteria, as well as valuable insights on market trends and neighborhood information.

Take Your Time

Don’t rush the house shopping process. This is your time to tour potential homes, ask questions, and get a feel for the property and the surrounding area.

Look Beyond Aesthetics

While it’s important to find a home that looks appealing, don’t let aesthetics be the only factor you consider. Look for features that will add value, such as a well-maintained roof, updated electrical and plumbing systems, and energy-efficient appliances.

Seriously Consider the Neighborhood

Look beyond the home itself and consider the surrounding neighborhood. Consider factors such as proximity to schools, shopping, and public transportation, as well as crime rates and overall safety.

Get a Home Inspection Before You Buy a House

Once you’ve found a property you’re interested in, be sure to get a home inspection. This can help you identify any potential issues or needed repairs before you make an offer.

Further, it’s absolutely essential to conduct inspections to identify any potential issues with the house. This includes a home inspection, which evaluates the overall condition of the house, and other inspections such as a pest inspection, HVAC and others as needed.

Be Prepared to Negotiate

Don’t be afraid to negotiate on the price or other terms of the sale. Your real estate agent can help you navigate the negotiation process and ensure that you get a fair deal.

By keeping these tips in mind and working with a knowledgeable Phoenix Valley real estate agent, you can find a house that meets your needs and budget and make a successful purchase.

Closing the Deal

Once you have found the right house, the final step is to close the deal. This involves making an offer, conducting inspections, and finalizing the mortgage.

Making an Offer on a House:

Making an offer on a house involves submitting a written offer to the seller that outlines the price you are willing to pay, any contingencies, and the proposed closing date. It’s important to work with your real estate agent to ensure that your offer is competitive and reflects the current housing market.

As a first time home buyer, it’s important to understand that making an offer on a house involves submitting a written agreement that outlines the terms of the sale. This includes things like how much you’re willing to pay for the house, when you want to close on the sale, and any other conditions that need to be met before the sale can go through.

You’ll also need to include a deposit, called earnest money, which shows the seller that you’re serious about buying the property.

After you submit your offer, the seller has the option to accept it, reject it, or propose their own terms. If they accept your offer, the house will be under contract. The next steps in the process will include things like getting a home inspection, securing financing, and finalizing the sale at a closing.

Buying a house can seem overwhelming at first, but a knowledgeable real estate agent can help guide you through the process and make sure everything goes smoothly.

Finalizing the Mortgage:

Once your offer has been accepted, the next step is to finalize your mortgage. This involves working with your lender to provide all the necessary documentation and information to complete the loan process. Your lender will also conduct an appraisal of the property to ensure that the purchase price is fair and accurate.

The House Appraisal

When planning to buy a house, it’s important to understand the purpose and importance of a house appraisal. An appraisal is essentially an expert evaluation of the property’s value, conducted by a licensed appraiser. It’s important because it helps to ensure that you’re not overpaying for the home you’re interested in, and it can also protect you from buying a property that’s worth less than what you’re paying for it.

The real estate appraisal process involves a thorough examination of the property, including things like its size, condition, location, and any recent upgrades or renovations. The house appraiser will also compare the property to other similar homes in the area to determine its market value.

As a first time home buyer, it can be nerve-wracking to think about spending so much money on a property. However, a thorough house appraisal can give you peace of mind that you’re making a smart investment in your future. So, even though it might seem like just another step in the home buying process, a house appraisal is an essential part of ensuring that you’re getting the most value for your money.

Closing Day on a House

The final step of how to buy a house in Phoenix is closing the deal. This involves signing all the necessary paperwork and paying any closing costs and fees. You will also receive the keys to your new home and officially become a homeowner.

Buying a house in Phoenix AZ can be a complex and challenging process, but with the right preparation and guidance, it can also be incredibly rewarding. Troy Elston is a Phoenix Area Realtor that’s dedicated to helping you navigate the process of buying a house and finding the home that best meets your needs and preferences.

By following the steps outlined in this guide and working with a knowledgeable and experienced real estate agent such as Troy, you can shop for a home with confidence and find the perfect home for you and your family.

Additional Resources Related to How to Buy a House

- “Buying a house: Tools and resources for homebuyers” by the Consumer Financial Protection Bureau

-

Is The Phoenix Housing Market Cooling Down?

The Phoenix housing market has been sizzling for years, with prices skyrocketing and buyers engaging in intense competition. However, recent developments hint at a potential

-

How to Snag the Best Mortgage Interest Rate

So you’re ready to buy your first home! You’ve been dreaming of this moment, and you’re probably ready to jump into the market and start

-

Arizona Down Payment Assistance

If you’ve ever wondered if you could get help buying your house from an Arizona Down Payment Assistance Program, then read this article to see